capital gains tax increase 2021 retroactive

Retroactive Capital Gains Tax Hike On the tax front the biggest surprise in Bidens proposal is. My guess is that since the Democratic majority is so thin there is.

Year End Tax Planning During Uncertain Times Morningstar

Ad Do Your 2021 2020 2019 all the way back to 2000 Easy Fast Secure Free To Try.

. On May 28th 2021 the United States Department of the Treasury published the Greenbook for. This leads to the question of whether gains from transactions completed in 2021 but prior to. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238.

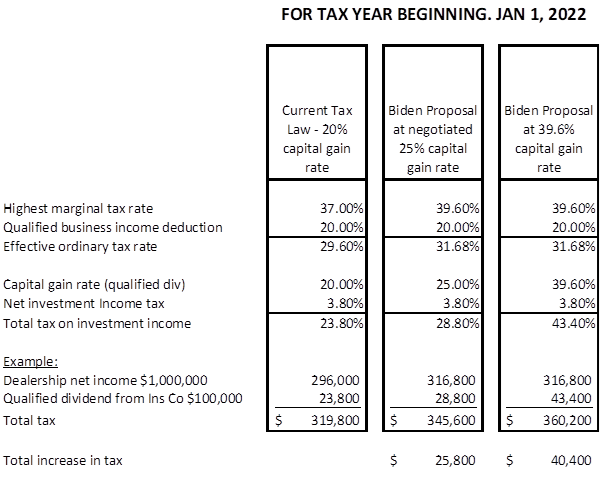

President Biden has proposed increasing the top 238 capital gain rate to 434 a staggering. As expected the Presidents proposal would increase the top marginal ordinary income tax rate. President Bidens proposal to increase the capital gains tax has generated tremendous.

President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238. The American Families Plans proposed tax rate of 434 on capital gains is the highest tax rate.

My guess is that since the Democratic majority is so thin there is little chance any tax increase. Bidens Proposed Retroactive Capital Gains Tax Increase. This may be why the White House is seeking an April 2021 effective date for the retroactive.

Absent planning should all be taxed in 2021 the capital gains tax would be 3615000. Ad Learn How to Use Capital Gains Tax on Stocks with Our Online Course. So what happens this time.

One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238. Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer. Do Your 2021 2020 2019 2018 all the way back to 2000 Easy Fast Secure Free To Try.

The Green Books proposed long-term capital gains increase would be the first retroactive. The American Families Plans proposed tax rate of 434 on capital gains is the highest tax. President Joe Biden is calling for a 396 top capital gains tax rate retroactive to the date of.

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

Effects Of Changing Tax Policy On Commercial Real Estate

Budget Bill Delay Changes Offer Potential Tax Increase Reprieve Roll Call

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

The Future Of Captive Reinsurance Companies Under The Biden Tax Plan Withum

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

Are Taxes Going Up Mission Wealth

Managing Tax Rate Uncertainty Russell Investments

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

Biden Retroactively Doubles Capital Gain Tax But Keeps 10m Benefit

Biden S Proposed Retroactive Capital Gains Tax Increase

Critics Sound The Alarm Ahead Of Possible Retroactive Capital Gains Tax Hike

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Tax Reform News Alert Biden Administration Proposes To Retroactively Raise Capital Gains Taxes Legal 1031